Individual Tax Rate 2017 Malaysia

Here are the many ways you can pay for your personal income tax.

Individual tax rate 2017 malaysia. On 10 april 2017 the income tax exemption no. Under current law amt exemptions phase out at 25 cents per dollar earned once taxpayer amti hits a certain threshold. Green technology educational services. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

Which is why we ve included a full list of income tax relief 2017 malaysia here for your calculation. While the 28 tax rate for non residents is a 3 increase from the previous year s 25. An approved individual under the returning expert programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in malaysia for 5 consecutive yas. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

Some items in bold for the above table deserve special mention. Technical or management service fees are only liable to tax if the services are rendered in malaysia. Such qualifying persons are required to have been carrying on a business for more than two years and earned chargeable. 2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act.

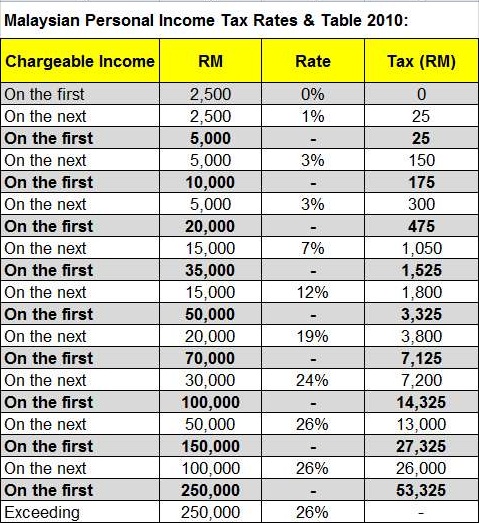

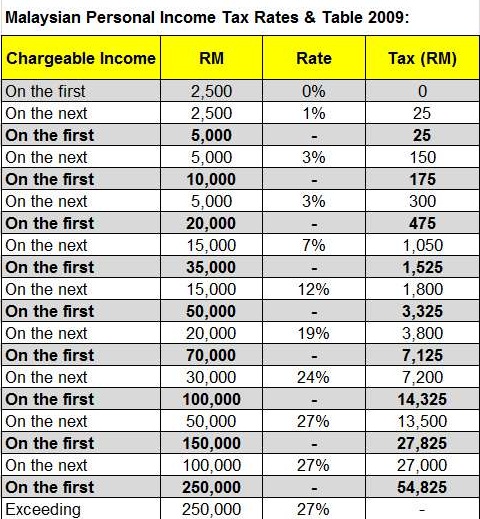

Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28. Individual relief types. No guide to income tax will be complete without a list of tax reliefs. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower.

A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.