Difference Between Islamic Capital Market And Conventional Capital Market

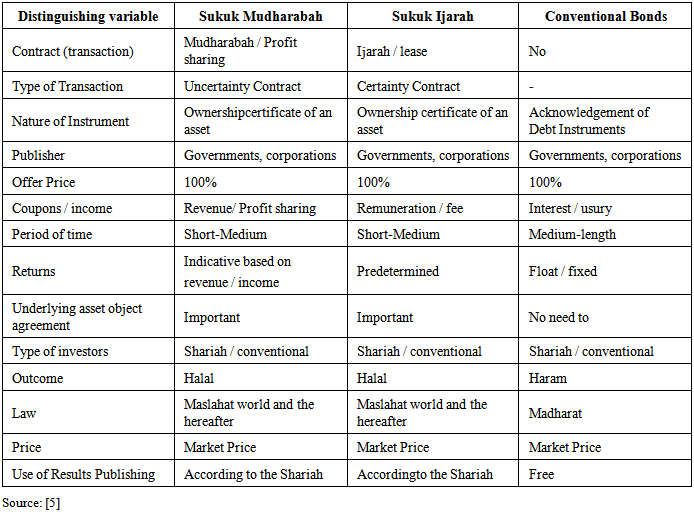

This paper investigates the impact of conventional bonds and sukuk announcement on shareholder wealth and their determinants using 79 sukuks and 87 conventional bonds over the period of 2004 2012 in six developed islamic financial market.

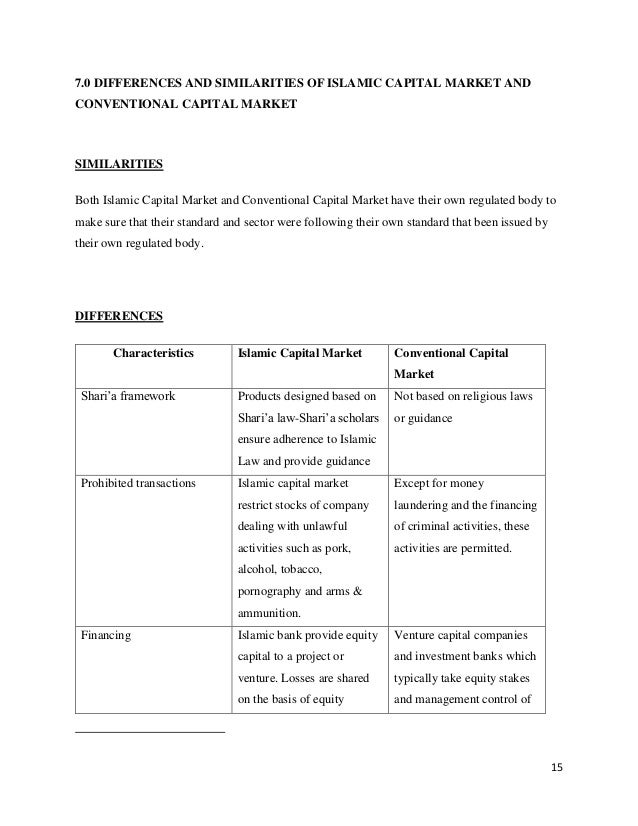

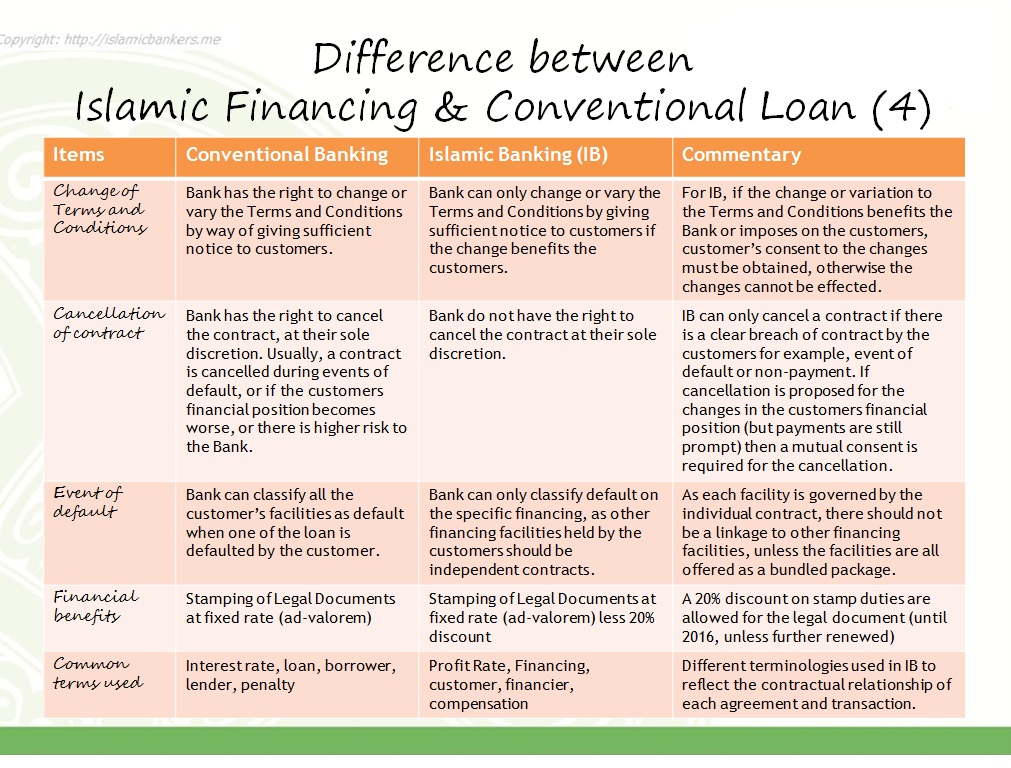

Difference between islamic capital market and conventional capital market. Difference between conventional with capital market islamic capital market. Capital markets must be supervised and controlled by regulatory bodies. Almost everyone today has heard of the terms. However these entities are governed both by islamic laws and by the finance industry rules and regulations that apply to their conventional counterparts.

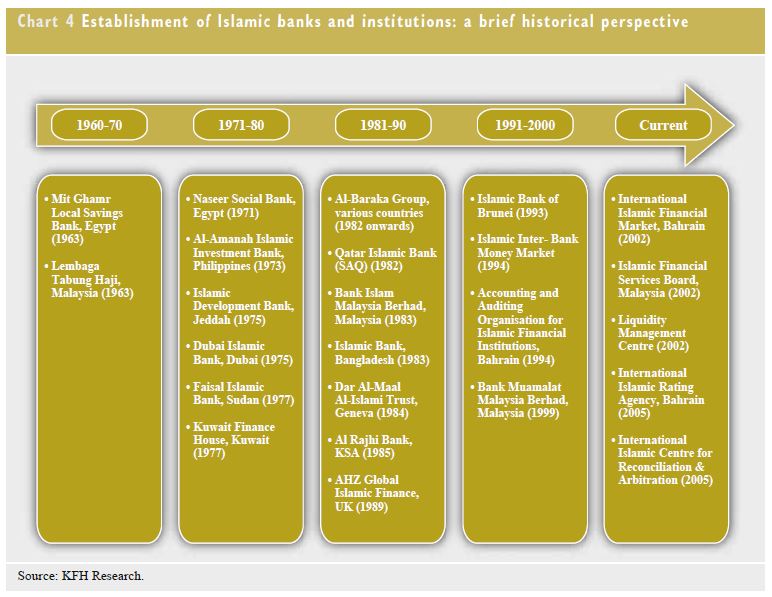

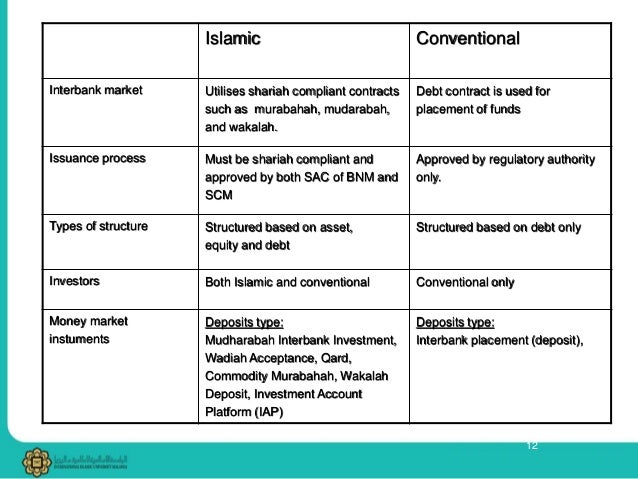

There are some similarities between islamic and conventional pe like for example the active participation the quick exit of the pe fund and the close partnership. Islamic capital market products exist mainly in six main places. Because the islamic capital market is in its infant stage no organized regulatory authority exists for it. Unlike in the capital market only islamic bank islamic commercial bank or islamic business units are allowed to issue financial instruments in the islamic money market.

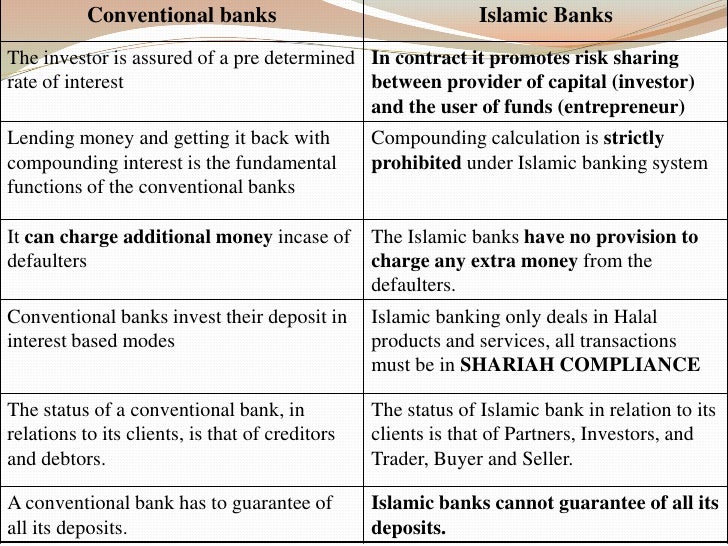

A major difference between conventional accounting and islamic accounting lies in the definition of assets. But they display also different features. There are two main things in the islamic capital market indices namely islam and islamic capital market itself. Aaoifi defines asset as that which the enterprise has acquired rights to hold use or dispose and does not recognise asset based on ability to control through other than legal ownership.

Includes sharia acompliant stock and or sukuk markets. Islamic index shows the movement of the share prices of issuers that are categorized according sharia while the islamic capital market is the capital market institutions as commonly applied based on islamic principles. Places the islamic capital market is traded in the same places as the conventional ones since no islamic only exchanges exist. Any market in which sharia acompliant securities are traded.

Companies and governments use the islamic capital markets to raise funds for their operations or expand ongoing activities e g. The differences between the two types of bonds are negligible at best as the intention of each is to preserve investment capital. Generally the conventional capital market authority in any given country or region supervises the islamic capital market as well. Private equity pe venture capital vc and leveraged buy out acquisitions lbo.

Just like conventional financial systems islamic finance features banks capital markets fund managers investment firms and insurance companies. A company may undertake an ipo. Other players in financial industry such as conventional bank insurance or re insurance takaful or re takaful and leasing company are only allowed as an investor. The conventional capital market main customers are profit seekers who are either providers of funds or demanders of funds.